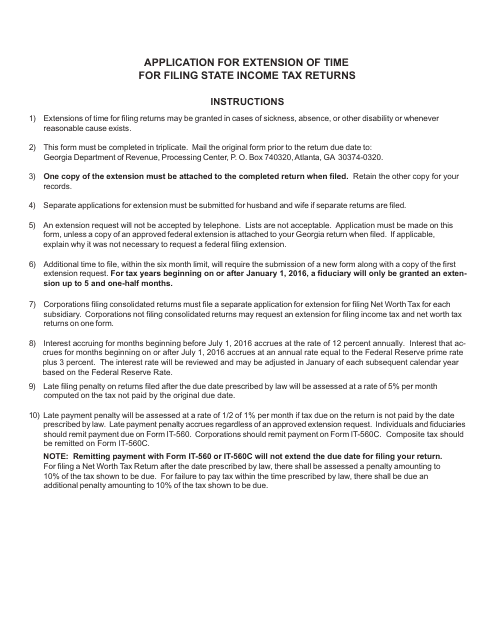

Full payment of any tax liability, less credits, is due with the extension request. The extension of time to file is not an extension of time to pay. Note: Copies of a federal request for extension of time to file are not acceptable. Complete the ‘Military Combat Zone’ on your Extension of Time to File, FR-127. The extension also applies to spouses/registered domestic partners, whether they file jointly or separately on the same return. Deadlines for filing your return, paying your taxes, claiming a refund, and taking other actions with OTR is extended for persons in the Armed Forces serving in a Combat Zone or Contingency Operation.

You must file the first 6-month extension by the April 15 deadline before applying for the additional extension of time to file by October 15.Įxtensions for Members of the US Armed Forces Deployed in a Combat Zone or Contingency Operation. You may receive another 6-month extension if you are living or traveling outside the U.S. The extension is limited to six (6) months. An extension of time to file a return may be requested on or before the due date of the return.

0 kommentar(er)

0 kommentar(er)